In the pursuit of a sustainable future, Australia has unveiled a refreshed National Hydrogen Strategy, led by Federal Climate Change and Energy Minister Chris Bowen. This initiative underscores Australia’s intent to foster a thriving green hydrogen industry, positioning the nation as a forerunner in low-emission technologies amid the global race towards net-zero emissions. The updated framework builds on the groundwork laid in 2019 by previous Chief Scientist Alan Finkel, emphasizing the evolutionary nature of national strategies in response to shifting environmental, economic, and technological landscapes.

Hydrogen stands as the first element on the periodic table, renowned for its omnipresence and versatility. Traditionally, hydrogen is produced through methods that may emit greenhouse gases, such as natural gas reforming. However, Australia’s focus is now directed toward “green” hydrogen, produced from water using renewable energy sources—an approach that promises to significantly reduce carbon footprints. This new strategy aims to increase production to meet ambitious targets: 500,000 metric tons annually by 2030, scaling up to a staggering 15 million metric tons by 2050. Notably, the strategy introduces stretch goals of 1.5 million and 30 million metric tons for the same respective years, indicating a commitment to aggressive growth in this sector.

A critical aspect of the strategy centers around the economic viability of green hydrogen production, which currently lags behind fossil fuel alternatives in terms of cost-efficiency. The government’s intent to scale up production aligns with the necessity of enhancing green hydrogen’s competitiveness in the global market. However, the earlier goal of producing hydrogen for less than $2 per kilogram has been discarded, recognizing the associated overhead costs, including transportation and storage. This pivot signals the realization that merely setting targets is insufficient; meaningful strategic decisions and investments need to be channeled to nurture these emerging markets successfully.

Hydrogen’s potential reaches far beyond transportation; it can transform industries like steel and chemical manufacturing, which are currently reliant on fossil fuels. The strategy identifies iron, alumina, and ammonia as key sectors to harness hydrogen in producing new exportable commodities. Furthermore, it presents promising avenues in aviation, shipping, and electricity storage. Yet, the reality remains that hydrogen’s adoption in some areas, such as passenger vehicles, has been eclipsed by the faster advancements seen in electric vehicle technology. This reality demands critical strategic alignment to ensure investments are directed toward promising avenues of hydrogen deployment.

While the strategy lays out an ambitious roadmap, it inadvertently raises questions about its implementation. Will priority sectors receive preferential access to funding? How will the government delineate support for viable projects against less promising ones? This lack of transparency can discourage potential investors who seek clarity on the government’s priorities and long-term framework. The challenge lies not only in crafting an ambitious strategy but ensuring that it resonates with investors and stakeholders, facilitating informed decisions about where to anchor their resources.

The 2019 strategy’s export focus on liquid hydrogen, primarily targeting Japan and South Korea, has evolved, now eyeing Europe as a critical market. Notably, a collaboration between Australia and Germany, involving a substantial A$660 million investment, highlights this shift. However, the challenges of transporting hydrogen, given its volatility and associated costs, provoke a reevaluation of whether Australia should prioritize domestic production and utilization over export. There is an emerging consensus that producing green hydrogen for local heavy industry may yield better economic and environmental outcomes than merely exporting raw hydrogen abroad.

Safety concerns surrounding hydrogen production remain paramount, particularly in light of past incidents related to explosive gases. The latest strategy wisely focuses on community benefits such as job creation and bolstering regional economies. Effective stakeholder engagement, especially with First Nations communities, is framed as a priority for managing potential impacts on local resources, such as water. This holistic approach signifies a more inclusive strategy, recognizing that social license is as critical as financial viability in the deployment of new technologies.

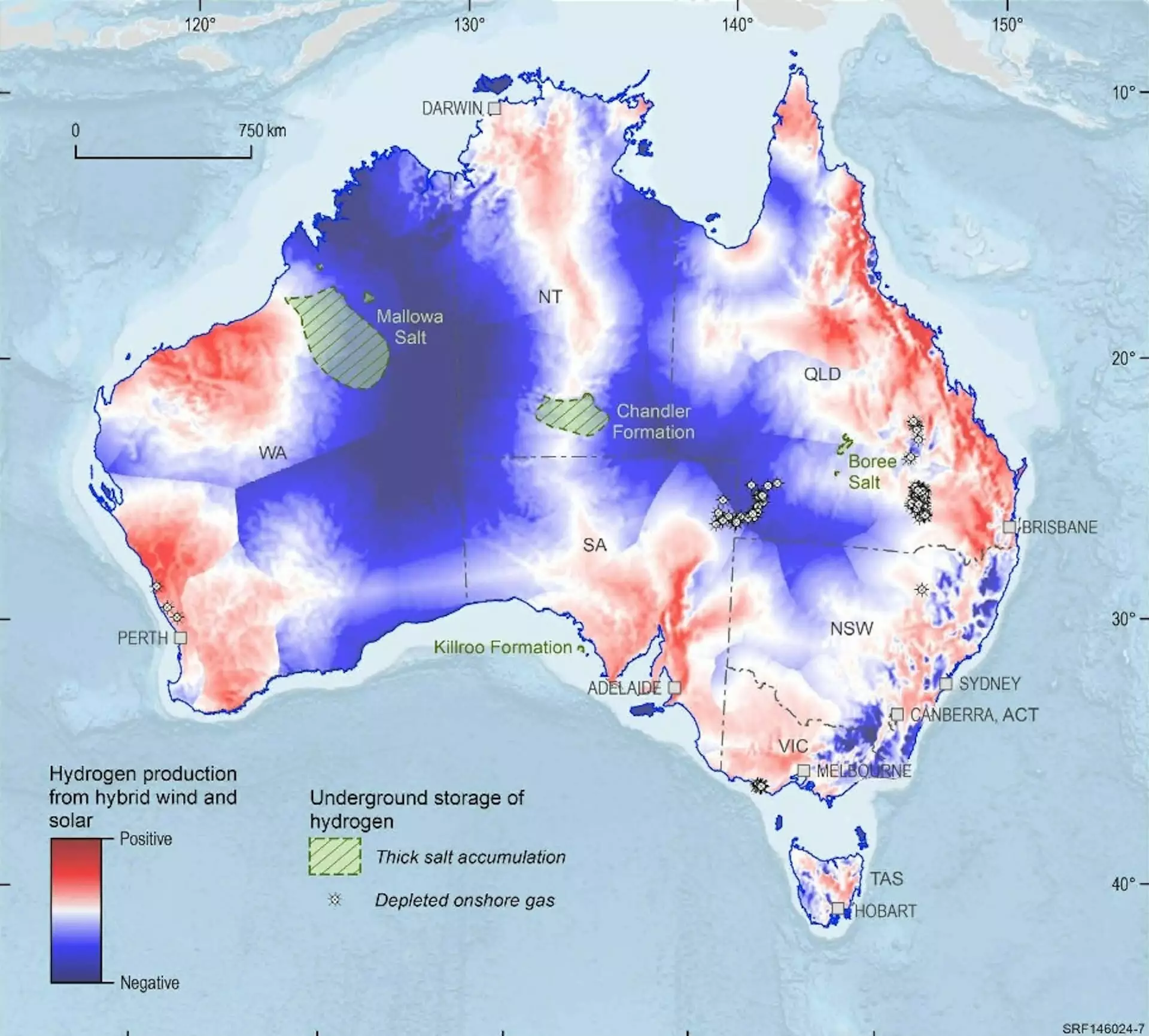

The current National Hydrogen Strategy is set for a review in 2029—an appropriate timeline in which to assess its success in practical terms. Metrics for success will include the development of large-scale hydrogen projects, securing contracts, establishing storage facilities, and transitioning from fossil fuels in key industries. As Australia navigates the complexities of hydrogen production and technology, the nation must remain agile and adaptive, ready to recalibrate its strategies based on emerging realities. In a decade marked by innovation and regulatory evolution, Australia’s hydrogen journey offers a crucial case study into how nations can balance ambition with actionable plans for a sustainable future.

Leave a Reply